Pay by Bank (Open Banking) Payments Versus Other Payment Methods

How does Pay by Bank compare to other methods of payment (debit/credit cards, bank transfers, etc)?

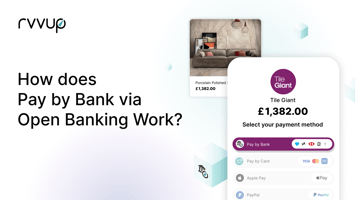

Open Banking Pay by Bank is proving an efficient method of payment for goods and services online. The benefits are extensive for the consumer, but also for the e-commerce merchant. There’s no need for buyers to manually enter their card details, it’s a far more secure method of payment with less risk of fraud and for merchants, the transaction fees are as much as 7-9x lower.

Furthermore, it reduces time spent taking care of admin and reconciliation needs, speeds up the transaction process and ensures that merchants are paid instantly – improving cash flow. Payment success rates are far better too – up to 40% and that’s because Open Banking is more readily designed for online payments, whereas credit and debit cards are not.

Below, we detail the key differences between the different online payment methods.

Pay by Bank Vs Card Payments

- Pay by Bank is a low-cost option, whereas card payments have higher transaction fees attached to cover the multiple parties that facilitate the payment.

- Open Banking payments are instant, so they settle immediately whereas card payments can take up to 3 days to clear. This quick clearance with Pay by Bank can provide improved cashflow for e-commerce businesses.

- For consumers, Pay by Bank is a better experience as there’s no manual input of pertinent data – everything is done at speed through the consumer’s own bank account app or website. Sometimes, card details are stored on websites which can improve the consumer’s experience – but when details are stored, it also heightens the risk of fraud and data breaches.

- Open Banking payments conversion has a high success rate of 95% whereas cards are lower, at 85%.

Open Banking Pay by Bank Payments Vs Standing Orders

Standing orders are set up by the bank account holder and involve automated payments of fixed amounts. They’re often used between friends, family, and accounts, but they can also be set up through Open Banking which brings more benefits. Through Open Banking, they’re easier to set-up, automate, and can be more reliable. They’re also easy to stop too.

- Standing orders through Open Banking to merchants have low cost, but through traditional methods, while the transaction fees are low, the operational costs are high due to manual processing.

- In both cases, standing orders are instant whether through Open Banking or through a bank account set-up.

- As far as user experience goes, it’s much easier to set up a standing order and integrate it at the checkout stage through Open Banking. Using the traditional method, it’s laborious and slow.

- Payment conversion through both options is good at around 95% success rate.

- Security for both options is also strong.

Open Banking Payments Vs Direct Debit

Direct debits are managed by a provider rather than the bank account holder (although the holder must give permission first). The other difference to a standing order is that a direct debit allows variable recurring payments (VRP) amounts. As far as Open Banking goes, it’s in its early stages in the UK although will soon become a more regular option.

- In both cases, Open Banking and traditional set-up of direct debits the cost to the merchant is low.

- Settlement is instant in the case of Open Banking, but with traditional direct debit payments it can take anything from 3 to 5 days to settle..

- User experience is far better for Open Banking as it’s quick and easy to set-up at checkout, and the traditional route is cumbersome, with a mandate needed to organise a direct debit but once set-up, it’s relatively straightforward.

- Payment conversion with both is usually highly successful.

- Security with Open Banking Pay by Bank is high, with traditional direct debit it’s not as strong.

Open Banking Payments Vs Manual Bank Transfer

A manual bank transfer requires the user to login to their bank account, input the payee and payment details manually and then organise the amount. For businesses, it’s a similar process and while it is low cost it is inefficient.

- In both cases, transaction fees are low but in the case of manual bank transfers, the operational costs are higher as it’s a manual process.

- Settlement speed is high for both Open Banking and manual bank transfers.

- For Open Banking, bank transfers’ user experience is good as it’s quick and easy but in the case of manual bank transfers, the experience is poor as it requires many manual actions including entering payment information.

- Payment conversion in both cases is 95% successful.

- Security in both cases is strong.

Open Banking and Pay by Bank is revolutionising payment processes - with faster response, instant fund transfer, and low-cost to merchants. Furthermore, it’s an automated process which reduces time and improves efficiency. The system does need to extend to include more direct debit processes, but this will happen in time.