Why Is Open Banking Good for Consumers?

Open Banking can be used to facilitate payments that allow online buyers to perform transactions securely, without needing to key in personal information. Not only does it facilitate safer online transactions, but there’s another key aspect of Open Banking that’s proving very effective and efficient. Due to the “open” nature of Open Banking, the shared data is used to offer customers connected services by analysing their financial information. These services are designed to be the right fit for the customer’s needs as well as to enhance their banking journey.

Safe Sharing of Consumer Data

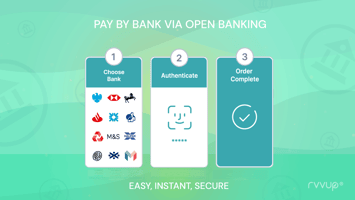

In using Open Banking, consumers still have to allow their data to be shared, ticking the “consent” box. Data is shared through API software instantly (Application Programming Interface) – but this data-sharing is secure because it’s completely automated and no details are ever keyed in online. The benefits of not needing to key in financial data include security against online fraud because financial data is less likely to be stolen by cyber criminals as they can’t access it.

Transactions In Real Time

Additionally, the process is swift and seamless, transactions occur in real time, funds are transferred in seconds and confirmation is instant.

Innovation in Financial Products

Another benefit is that financial institutions are becoming more and more competitive, offering better financial products that are innovative and useful. There are numerous new products appearing on the market, such as faster and easier cross-border payments, cross-selling products and better solutions for customers looking for improved ways to reach their financial goals.

Furthermore, as Open Banking is rolling out to more countries in the world, it is being regulated to ensure that customer data is protected, underpinning the security of this modern payment method.

Other Open Banking Benefits

- All Financial Information Stored In One Place - so consumers can access their different financial services from one place rather than from multiple providers and they can view everything related to their finances in a single app. So, consumers can manage their budget, track their accounts, their credit card spending, loans etc without switching to different screens or mobile banking.

- Better Control of Financial Data - so Consumers have greater control over their information, how it’s used and who can access it.

- Faster Credit Offers - as Open Banking accesses consumers’ financial information quickly and securely, those seeking loans can gain access to borrowing quickly and easily with offers that are carefully selected to appeal and that are suitable according to different financial situations.

- Easy Instalment Payments using Open Banking - consumers can make instalments and/or recurring payments in one place.

- Fast Refunds - Open Banking allows for quicker refunds and an easy way to rectify payment mistakes!

On-Demand Payroll

Furthermore, Open Banking is paving the way for easier access to finance – for example, in Latin America, there’s a new financial model called On-Demand Payroll which allows users to get their pay checks paid into their account whenever they want – without waiting for their pay day! This is helping many people to avoid having to take out loans if they need money in advance.

Some Final Thoughts On Open Banking

Open Banking is just the start of new ways for consumers to enjoy better access to financial products and enhanced online security when paying for goods and services online. There’s no doubt that Open Banking will continue to evolve, with more and more competitive financial products being made available, easier transacting cross-border and improved methods for billions of people across the globe to manage their money.