Why are Open Banking Payments (Pay by Bank) Good for Ecommerce Businesses?

While Open Banking and pay by bank has plenty of excellent benefits for consumers – you might wonder what advantages it offers for eCommerce businesses?

While Open Banking aka Pay by Bank has plenty of excellent benefits for consumers – you might wonder what advantages it offers for e-commerce businesses? Without doubt, this modern payment system is now more in demand than ever before. It is becoming increasingly used by consumers to purchase goods online because it is far more secure due to there being no need to key in any financial information, therefore reducing the risk of online fraud. The future looks very bright for Open Banking payments (Pay by Bank) and it is easy to see why it has become increasingly important for e-commerce businesses to accept Pay by Bank as a complimentary and/or alternative to cards, e-wallets and other more traditional payment methods.

The Benefits for E-commerce Businesses

Much Lower Fees

For e-commerce businesses there are plenty of advantages. For one, the transaction fees are very low. Secondly, settlement time is instant whereas businesses still have to wait several days to receive their funds with card payments. The payment process is much faster – payment confirmation occurs in seconds and money is transferred in real time, which is massively beneficial for a business’s cash flow. The instant speed of confirmation is then reassurance to e-commerce businesses to be confident to despatch their goods faster, which is of course a much better buyer experience.

Reduced Fraud

Open Banking reduces online fraud. Payments go automatically through SCA (Strong Customer Authentication) and security detection. This coupled with the absence of a risk of chargebacks means Open Banking is continuing to prove itself as a formidable payment method for e-commerce businesses (and consumers).

Fewer Payment Service Providers

E-commerce businesses using Open Banking don’t need so many partnerships and contracts with third parties payment service providers, other payment method providers, fraud solutions etc. This all helps to reduce the overall cost of sale.

Customer Satisfaction

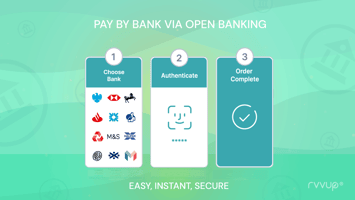

More relevant payment options = higher conversion. Customers are far more likely to buy when they see their favourite payment method. Open Banking is fast becoming popular as a method because there’s no need to enter any card details – the consumer simply approves the payment on their every day banking app or website, and one click is all it takes to complete the transaction.

Ideal for Today’s Digital Needs

Of course we cannot forget that Open Banking payments are built for the current online world – credit and debit cards were adapted for online payments from an offline world, whereas Open Banking reflects today’s needs built natively for online purchases, to improve the experience for both E-commerce businesses and consumers. It’s an amazing innovation and already evolving rapidly. Embracing it now gives E-commerce businesses the edge on providing their buyers with the best customer purchasing experiences and increasing conversion as a result.

Easy Collection of Automated Payments

Lower your post-sale costs. More than a payment solution for online shopping, Open Banking can also provide services after the sale. Sending out text messages and/or QR codes for missed payments, and providing a method to collect automated payments, are additional ways in which Open Banking will reduce costs attached to the debt recovery process in the future.

Final Thoughts on Open Banking & Pay by Bank for E-commerce businesses

Open Banking is useful now and will become even more important in the future. The lower costs, less fraud, faster payments, and superior user experience will mean more satisfied customers, and all point to Open Banking’s prominent place in the payment landscape of the now, the near future and beyond.